Best Alternative To Entropay

Virtual credit cards have gained popularity in recent years. Many people have replaced their conventional credit cards with VCCs. These VCCs are better than credit cards for online shopping. But, these VCCs can’t be used for offline shopping. Still, they are loved by many users.

Paysafecard is the perfect Entropay alternative for those who used Entropay to budget successfully. Like Entropay, Paysafecard is a prepaid service which players must fund before funding their casino accounts. This helps players have control over their spending. To use Paysafecard, players must first purchase Paysafecard vouchers.

- Entropay Closing Down - Alternative Services. Last year in December, Entropay announced to their users that their service was going to be limited in February 2019. First, virtual Visa cards couldn't be topped up anymore and the balance was going to be transferred to the e-wallet.

- Best Entropay Payment Alternatives. Former Entropay fans still mourning your best Entropay Casino, don’t get discouraged! If you still prefer the familiarity and convenience of an ewallet or virtual prepaid card, you can find plenty of trusted alternatives that are just as safe for nostalgic punters.

Nowadays, it is very difficult to get a credit card. Most banks do an extensive background check before handing out conventional credit cards. Thus, many people find it hard to get credit cards. There are no such problems with VCCs. You can get yourself a VCC without doing much formality. Hence, many people love using VCC or VCCs. To understand more how A VCC works, head over to this online CC generator for more details and explanation. In the article, we will tell you the benefits of using VCCs. Also, we will tell you the best VCC providers in 2021.

Contents

- The Benefits of Using these Best Virtual credit cards

- Only Free Best VCC Providers for 2021

Best Free Virtual Credit Card Providers 2021

A VCC is actually like a prepaid credit card. You can fund this credit card in advance. Thus, you can use it to buy anything online. The best thing about this credit card is that you don’t need the approval of any bank. Hence, you can easily get a VCC.

This type of credit card is perfect for those people who shop online. Almost all online merchants accept VCCs. Hence, you can use this card to buy important things from online stores. Most of the VCC providers provide VCC for free.

Entropay Virtual Credit Card

The Benefits of Using these Best Virtual credit cards

First, we will tell you about the benefits of using these VCCs. Hence, you will get to know if this card is perfect for you or not. After that, we will discuss about the free VCC providers in 2021. Some of the benefits of using these VCCs in 2021 are:

1. Popularity of these VCCs

VCCs are not new in the market. They have been around for quite a while. Thus, almost every major e-commerce store has started accepting these VCCs. Also, other merchants have started accepting VCC. The popularity of VCCs is increasing every day.

This is the main reason why most people prefer VCCs. They can use these VCCs to shop online. The usage of VCC is increasing every day. Thus, you must start using them now.

2. Safety is King from These Best VCCs

VCCs are very safe when compared with regular credit cards. You don’t need to link your VCC with your bank account. Thus, no one can steal your bank details. Also, you don’t need to enter your personal details during an online transaction.

VCCs also have a scam protection system. If you got scammed, then you can chargeback your money. Hence, it is perfect for doing online shopping. You don’t have to worry about online scams or your personal details.

3. Flexibility to the Core of VCCs

Every credit card comes with a set limit. The credit card limit depends on your credit history. Sometimes it also depends on your bank balance. But, there is no credit history in VCCs. Also, they don’t check your bank balance.

Thus, the VCC mostly depends on your provider. You can easily increase or decrease this limit according to your needs.

You can put VCC limits according to your preference. Also, you can choose the payment limits and time according to your needs.

Contents

- The Benefits of Using these Best Virtual credit cards

- Only Free Best VCC Providers for 2021

4. Cross-Border International Transactions & Currency Conversion at Fingertips with such Free VCC Providers

Most people need credit cards to do international transactions online. Thus, you need to get good exchange currency rates. Thankfully, VCC will give you good currency exchange rates on every transaction.

Also, you can easily change your currency according to your needs. If you are shopping on a European website, then you can set your currency to EUD. Similarly, if you are shopping on an American website, then you can set your currency to USD. This feature will definitely help you when you are shopping on international websites.

Only Free Best VCC Providers for 2021

Entropay Usa

These were all the benefits of using VCC. There are many more hidden benefits which you will learn after using these VCC's. Now, we will tell you how to get these VCCs easily.

There are many VCC providers online who provide these types of credit cards. Each of them has different prices, limits, rules, and services. Thus, we have discussed all the major VCC providers. Some of the best VCC providers are:

Entropay - VCC Link

Entropay is definitely the most famous VCC provider. They have been providing VCCs for years. Thus, many people choose Entropay.

All you need to do to grab your VCC is signup on this website. They will ask for some basic information like your name and address. After providing your personal information, you need to verify your account. The best thing about the Entropay is that the signup process is completely free.

But, they will cut a small fee for every transaction. Although the fee is very small and it will mostly go unnoticed. Once you have verified your account, you can fund your account using your bank account. After that, you can do transactions online.

American Express - VCC Provider

AmEx or American Express also provides VCCs. They are one of the major providers of conventional credit cards. In recent years, they have started providing VCCs also.

You can use these VCCs for international shopping. Also, you can use them to buy web hosting services, and making an online transaction. Many people use them to send payments to various online companies.

Netspend - VCC Provider Link

Netspend is one of the best VCC providers in 2021. It is free to sign up on Netspend. But, they will cut a small fee from every transaction. They provide many unique features to their users.

You can link your debit card from Visa or MasterCard Prepaid card with your Netspend account. But, this service is limited to the US only. You can use VPN or proxy servers to bypass this geographical restriction.

Payoneer - VCC Provider URL

Payoneer is one of the most reputed VCC providers in the market. They provide great services and features to their users. You can use Payoneer to turn your regular prepaid cards to VCCs. Hence, you can fund your Payoneer transactions via prepaid cards.

Just like most of the other VCC providers, the signup process is free on Payoneer. But, they will cut a small fee for every transaction. You can use Payoneer to do online transactions and shop online. But, Payoneer is not limited to online shopping only. You can use it to send and receive funds also. Thus, it acts as a PayPal alternative.

Netteller - VCC Link

Netteller is perfect for those users who use PayPal. You can fill Netteller with PayPal money. Thus, you can do PayPal transactions without linking your credit card. You can also use your Netteller account to verify your PayPal account.

It is very easy to register on the Netteller website. All you need to do is contact the customer support. There are very simple steps that you have to follow like entering all personal details. You also need to upload your ID on Netteller. After the verification process, you can use it to do online transactions.

Com - Provider Link

Entropay Visa

Com is a US-based VCC provider. There are several features which this VCC provider offers. There are many different types of services and packages available on this website. Thus, you can choose the package according to your needs. Also, you can remove the services you don’t need.

The fee which they charge is also very low when compared with other VCC providers. Also, you don’t need to worry about the extra taxes.

Bank Freedom

The Bank Freedom gives you total freedom to choose any type of Virtual credit card you want or need. It is very easy to register on this website. Also, there are many different types of packages available on this website. You can choose the package which is perfect for you. Bank freedom assures that you can use their VCC on most of the online e-commerce websites.

Walmart Money Card - VCC Provider Link

Walmart is a very famous brand. Almost everyone knows about the Walmart shopping mall. But, Walmart is not limited to selling daily need products only. They also provide money cards which you can use a VCC.

But, these VCCs are available to US residents only. If you are a US resident, then you must Walmart Money card.

You can use Walmart Money card to do online shopping, pay for web hosting, or link your card with PayPal. You will also get various cashback offers if you are using these cards on Walmart.

These were all the things which you should know about VCC. We have already discussed in detail about the benefits of using these VCC. Thus, you must consider getting a VCC in 2021. You should consider various factors before choosing any VCC provider. Some of the factors are:

• What is the credit limit?

• What are the features of the VCC provider?

• What is the price of the premium package?

If a VCC provider is fulfilling all these points, then you must choose that provider. Otherwise, you must continue your search. We have already discussed the best VCC providers in 2021. You can go through this list and find the perfect VCC provider for you.

Entropay is a prepaid virtual Visa card that enables Canadian online casino players to fund their accounts securely and which is also easy and convenient to use. Accounts can be operated across fourteen different currencies (including CAD$) and deposits made using Entropay are credited to your casino account instantaneously.

Entropay 2.0

See our list detailing the top Canadian casinos accepting Entropay as both a deposit and withdrawal method below

Advantages of using Entropay as a deposit method

There are a number of advantages for Canadian players in using Entropay as a virtual visa card to fund an online casino account.

Anonymity: The main advantage of using Entropay is the anonymity it provides. Your transactions with your online casino do not appear on either your credit card or bank statements, meaning your online casino activities are anonymous and can’t be traced back to your bank or credit card statement.

Security: Using an Entropay virtual Visa card adds another security dimension to all of your online financial transactions, not least when dealing with an online casino. This is because you’re only required to share your Entropay card number with the casino, not any of your other bank or financial details. As a consequence, your financial data is completely secure with no data sitting on the casino’s servers. Additionally, all of your transactions at Entropay, whether depositing or withdrawing funds are protected by 128-bit SSL encryption.

Speed: Speed is another incentive for using an Entropay card. Anyone who has transferred funds using direct bank transfer will be aware of how long this can take, whether you’re moving money domestically or overseas. However, payments with Entropay are immediate, so there’s no waiting around for funds to clear.

Bankroll Management: As Entropay is a pre-paid debit card rather than a credit card such as VISA, you have more control over your expenditure. Any money you deposit into a casino account is ‘your’ money and not money on credit. For those who like to keep a close eye on their bankroll, or like to set themselves clear limits as to how much they deposit, this is the ideal solution as you can only spend money which is yours, not the bank’s (although there is the option to get an Entropay MasterCard ‘plastic’ credit card, if you think that would better suit your needs).

No credit checks: As Entropay is a pre-paid, virtual Visa card there is no need for credit checks. This means not only that you can get a card irrespective of your credit record, but also that there is no delay between applying and receiving your card. Simply apply online and your virtual card is with you straight away.

Multiple uses: Even if your primary purpose is getting an Entropay card is to make running your casino account easier, it’s not limited to this use – you can use your card to shop online at any store or service provider that accepts Visa cards, which means you’re actually getting a very versatile and convenient card that you can use in any number of ways. You can also access your Entropay account from any sort of device, from desktops to smartphones and tablets.

Accessibility: A further advantage is that money you withdraw from your casino account back into your Entropay account can always be accessed. So whether you want to withdraw that money to credit it back to your bank or credit card account, or use it for another online purchase, your funds are always available and instantly accessible.

Disadvantages of using Entropay

The main real disadvantage to using an Entropay prepaid virtual Visa card is the small fees incurred. While you won’t incur any charges at the top Entropay casinos we’ve listed above for transferring money from your Entropay account to your online casino account, there are nevertheless fees associated with loading funds to Entropay from your bank account or via credit card.

If you make a deposit to your Entropay account from a credit or debit card, there’s a fee of 4.95%, or 3.95% when you add funds using direct bank transfer. Third-party deposits into your account i.e., when you withdraw winnings from your online casino account, attract a fee of 1.95%. In addition, when you transfer cash from your Entropay account back to your credit or debit card there is a fee of $6.

However, for many players, these fees are more than outweighed by the convenience and added security of using Entropy as outlined above.

Transaction Type | Fees |

|---|---|

| Signing up | FREE |

| Create an Entropay Virtual VISA Card | FREE |

| Load Entropay card from credit/debit card | 4.95% |

| Transfer between Entropay cards | CAD $0.20 |

| Spend using Entropay card | CAD $0 |

| Return funds to personal credit/debit cards | CAD $6 |

| Destroy an Entropay card | FREE |

Setting up and funding an Entropay virtual Visa card

It is very quick and easy to set up an Entropay account, and once you’ve done so you can start using it immediately. There are no charges to set up an account, nor any annual fee or interest charges.

Go to www.entropay.com and click on Sign Up. You’ll then be asked to enter your name, email, date of birth and country of residence, and to create a username and password. Once you’ve done this, you instantly receive your 16-digit virtual Visa card number along with a 3-figure CCV number and, once funds have been deposited, this can be used straight away.

Entropay Contact Number

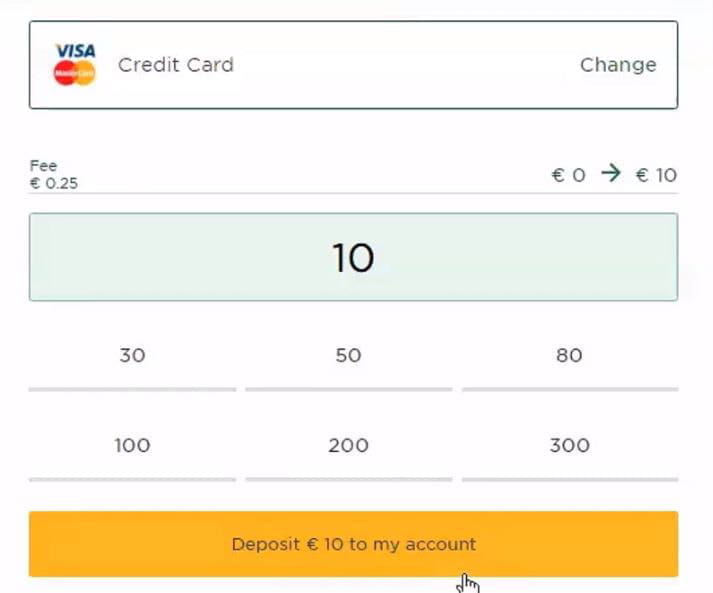

Once you have completed the above steps, loading money onto your account is similarly straightforward. You can choose to do this either via direct bank transfer or using a credit or debit card, with most major brands accepted. Anyone who has used internet banking, or made any sort of online purchase, will be able to accomplish this with ease.

How to deposit at an online casino using Entropay

Depositing funds at online casinos accepting Entropay will vary slightly from site to site, but generally speaking, the process is straightforward and runs as follows:

- go to Banking

- click on Deposit

- when presented with payment options, select Entropay

- follow the prompts (usually, Add Card, or Add Another Card)

- register your card by entering your 16-digit virtual Visa card number and 3-digit CCV (once you have registered your card for the first time, you won’t be required to do this again)

- enter the amount you wish to deposit

- click on Next to complete your deposit

The steps above are for those who have already set up their Entropay account. If this isn’t the case, you’ll be required to create your Entropay account between steps 3 and 4.

A cross between a credit card like and pre-paid card such as Paysafecard, Entropay offers secure, anonymous and instant payments making it a top way for Canadians to fund their online casino accounts. Click on the button below to start playing at a leading Entropay accepting casino